14 May 2025 | Wednesday | Reports

Charts from the 2Q25 Achieve household debt and credit study

Economic optimism fades as households continue to struggle under mounting debt and tight budgets.

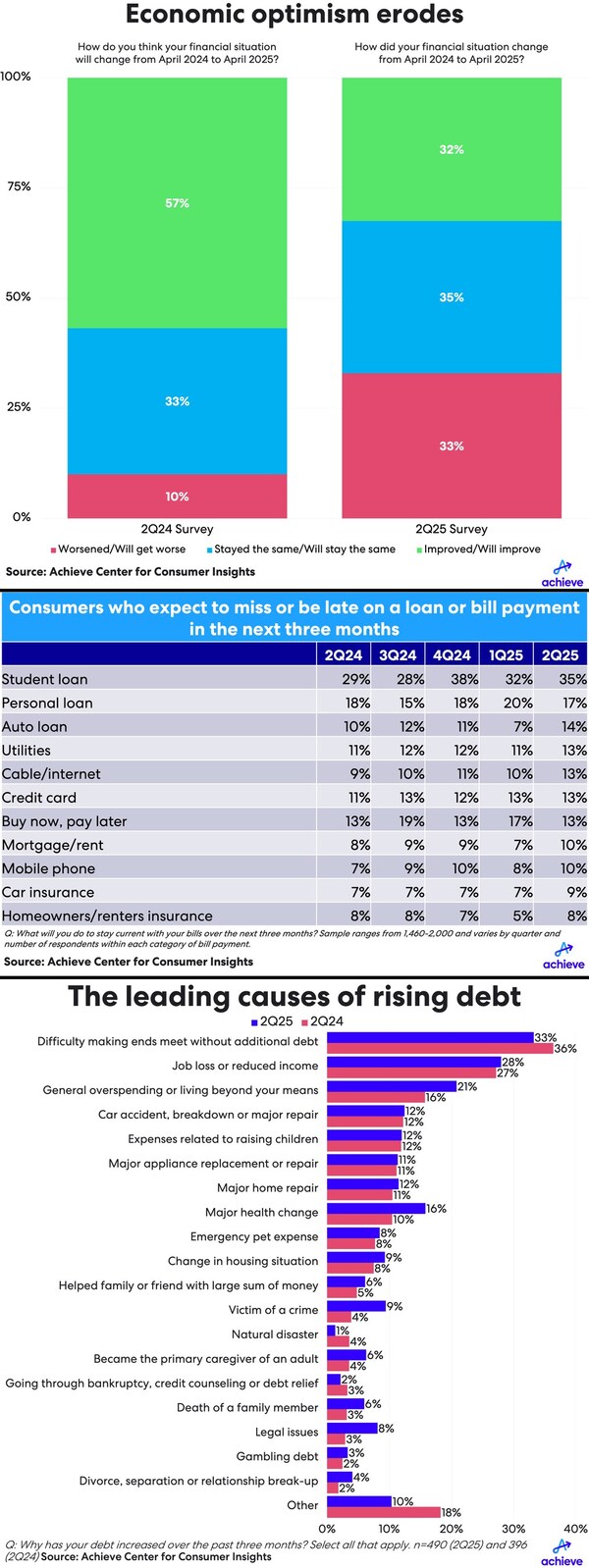

A new survey by digital personal finance company Achieve reveals a gap between consumers' financial expectations and their economic reality. While 57% of respondents believed their finances were poised for improvement over the past year, only 32% of American households actually realized those expected gains.

This reversal of fortunes underscores the fragility of household budgets as broad cost pressures from inflation, high interest rates and now, tariffs, push more consumers into relying on debt to make ends meet. Achieve's April 2025 survey found 33% of consumers said their financial situation deteriorated over the past year — a stark contrast from the 10% who predicted a decline in Achieve's inaugural survey in spring 2024.

"Households enter 2025 more pessimistic and with fewer financial gains in hand than most were expecting," said Achieve Co‑Founder and Co‑CEO Brad Stroh. "The optimism gap is a warning sign that highlights the need for tools and strategies that address the financial strain facing households. The reality of high debt loads, high interest costs and persistent inflation cast a sustained shadow on the financial optimism for many Americans."

|

Economic optimism erodes |

|||

|

Worsened/Will get worse |

Stayed the same/Will stay the same |

Improved/Will improve |

|

|

How do you think your financial situation will change from April 2024 to April 2025? (2Q24 Survey) |

10 % |

33 % |

57 % |

|

How did your financial situation change from April 2024 to April 2025? (2Q25 Survey) |

33 % |

35 % |

32 % |

|

Source: Achieve Center for Consumer Insights |

|||

The survey, conducted by Achieve's think tank, the Achieve Center for Consumer Insights, complements the Federal Reserve Bank of New York's Quarterly Report on Household Debt and Credit by providing qualitative insights into consumer borrowing and debt. The latest edition of Achieve's study highlights some of the risks that persistent reliance on debt poses for many consumers:

Missed Payment Risk Rises

Consumers are increasingly at risk of being late or missing debt and monthly bill payments, Achieve's survey found. Consumers reported a higher risk of missing a payment in the next three months on nearly all of the monthly obligations covered in the survey. In 2Q25, missed payment risk on student loans increased to 35% (up from 32% last quarter), while even secured debts like auto loans (14%) and mortgages (10%) are at greater risk of a late or missed payment, the survey found.

|

Consumers who expect to miss or be late on a loan or bill payment in the next three months |

|||||

|

Debt Type |

2Q24 |

3Q24 |

4Q24 |

1Q25 |

2Q25 |

|

Student loan |

29 % |

28 % |

38 % |

32 % |

35 % |

|

Personal loan |

18 % |

15 % |

18 % |

20 % |

17 % |

|

Auto loan |

10 % |

12 % |

11 % |

7 % |

14 % |

|

Utilities |

11 % |

12 % |

12 % |

11 % |

13 % |

|

Cable/internet |

9 % |

10 % |

11 % |

10 % |

13 % |

|

Credit card |

11 % |

13 % |

12 % |

13 % |

13 % |

|

Buy now, pay later |

13 % |

19 % |

13 % |

17 % |

13 % |

|

Mortgage/rent |

8 % |

9 % |

9 % |

7 % |

10 % |

|

Mobile phone |

7 % |

9 % |

10 % |

8 % |

10 % |

|

Car insurance |

7 % |

7 % |

7 % |

7 % |

9 % |

|

Homeowners/renters insurance |

8 % |

8 % |

7 % |

5 % |

8 % |

|

Q: What will you do to stay current with your bills over the next three months? Sample ranges from 1,460-2,000 and varies by quarter and number of respondents within each category of bill payment. Source: Achieve Center for Consumer Insights |

|||||

"When people are squeezed by debt levels and ongoing bills, their stress level rises," Stroh said. "Our data shows that even small income disruptions or timing mismatches can lead to late payments and these challenges are magnified by higher borrowing costs that make it more costly to carry debt balances."

Drivers of Rising Debt

Among respondents whose debt increased over the past three months, one in three (33%) pointed to difficulty making ends meet without borrowing, 28% cited employment and income challenges and 21% acknowledged falling victim to general overspending. Healthcare costs and other medical issues remain a key challenge, with 16% of respondents attributing their debt to these expenses.

|

The leading causes of rising debt |

||

|

2Q24 |

2Q25 |

|

|

Difficulty making ends meet without additional debt |

36 % |

33 % |

|

Job loss or reduced income |

27 % |

28 % |

|

General overspending or living beyond your means |

16 % |

21 % |

|

Major health change |

10 % |

16 % |

|

Car accident, breakdown or major repair |

12 % |

12 % |

|

Expenses related to raising children |

12 % |

12 % |

|

Major home repair |

11 % |

12 % |

|

Major appliance replacement or repair |

11 % |

11 % |

|

Victim of a crime |

4 % |

9 % |

|

Change in housing situation |

8 % |

9 % |

|

Emergency pet expense |

8 % |

8 % |

|

Legal issues |

3 % |

8 % |

|

Became the primary caregiver of an adult |

4 % |

6 % |

|

Helped family or friend with large sum of money |

5 % |

6 % |

|

Death of a family member |

3 % |

6 % |

|

Divorce, separation or relationship break-up |

2 % |

4 % |

|

Gambling debt |

2 % |

3 % |

|

Going through bankruptcy, credit counseling or debt relief |

3 % |

2 % |

|

Natural disaster |

4 % |

1 % |

|

Other |

18 % |

10 % |

|

Q: Why has your debt increased over the past three months? Select all that apply. n=490 (2Q25) and 396 (2Q24) Source: Achieve Center for Consumer Insights |

||

Methodology

The data and findings presented are based on an Achieve survey conducted in January 2025 consisting of 2,000 U.S. consumers ages 18 and older with an active account for one or more of the following categories of consumer debt: auto loan; major credit card with a minimum outstanding balance of $100; first-lien mortgage; home equity line of credit (HELOC); student loan; and other (unsecured personal loan, store-branded credit card, buy now, pay later loan, or closed-end home equity loan). The sample was augmented to include a statistically significant subset of credit card, auto loan and student loan borrowers who have been 30 days or more past due at least once in the past six months.

Fintech Business Asia, a business of FinTech Business Review

© 2025 FinTech Business Review. All Rights Reserved.